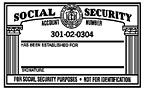

Identity theft perpetrators are becoming more sophisticated and skilled at stealing other person's identities with stolen Social Security numbers. The Social Security Administration received more than 30,000 complaints concerning the theft/misuse of Social Security numbers in 1999. The number of complaints rose to 26 percent over those reported in 1997, and 36 percent above the number reported in 1998.

You're in trouble if your Social Security number and birth date get in the hands of these culprits. They assume your identity, set up bogus bank accounts, obtain credit cards, rent homes or apartments, apply for loans, go on spending sprees and some have even declared bankruptcy. Guess what, you're left holding the bag, your credit and reputation is ruined, and it may take years and thousands of dollars to restore your credit rating.

To help stop this type of crime, legislation is in the mill to prohibit credit bureaus from selling Social Security numbers and birth dates, require the card issuers to provide a free credit report yearly to each cardholder, and notify any victims of identity theft. Because it may take victims months to discover that they've been swindled, an additional safeguard to prevent stealing through the mail is to verify whether the cardholder requested his card be sent to a new address. If passed, the legislation will allow the Social Security Administration to impose a $5,000 for the misuse of Social Security numbers.

In the meantime, keep track of personal information that can be used by a criminal to steal your identity. Never throw receipts, personal data or bank statements in the trash. These items are money in the pocket of the "dumpster divers." For a few dollars, you can purchase a small shredder to use at home to destroy your discards. The Federal Trade Commission has a hotline (877-438-4338) to report identify theft crimes. Or check its Web site, www.consumer.gov/idtheft.

Report Abusive Comment